Dive into macro, market and portfolio themes

A changing environment demands that we reassess how we construct and diversify portfolios. Investors need the whole toolkit to extend, expand and enhance their portfolios.

Executive Summary

Smarter portfolios for a world in transition

A 60/40 asset allocation (60% equities, 40% bonds) is still a great starting point for portfolios. And we can build on it in many ways.

That’s because much of what defines the investing environment is in transition.

Consider:

- The economy is in transition as persistent disinflation transitions to two-way inflation risk.

- Policy is in transition as ultra easy monetary policy transitions to more traditional monetary policy and fiscal restraint shifts to fiscal activism.

- Technology is in transition as the potential of artificial intelligence begins to emerge.

- Climate is in transition from conventional energy to renewable energy.

Extend, expand and enhance the 60/40

To navigate a world in transition we recommend that investors build on the 60/40 portfolio and:

Extend – out of cash and delve deeper within core assets

We forecast that one dollar in cash could be worth only USD 1.04 in real terms in 10 years. In a 60/40 with a 25% alternatives allocation, it could be worth USD 1.62. (The principle applies across currencies.)

Expand – the opportunity set, especially with alternative assets

International developed equities can capture rerating and currency upside, real assets improve inflation resiliency.

Enhance – portfolio outcomes through active allocation and manager selection

As money is no longer free, markets will reward a more selective approach to asset purchases.

In this year’s Long-Term Capital Market Assumptions, forecasts across most assets offer attractive long-term returns. Investors can use the whole toolkit to extend, enhance and expand their portfolios.

Higher bond returns, lower equity returns

With high prevailing policy rates, our Global Aggregate bond forecast jumps 40bps to 5.1%. Our equity return forecasts fall in the wake of the 2023 rally, but not as far as might be expected. Our forecast for global equities dips 70bps to 7.8%. U.S. large cap declines from 7.9% to 7.0%.

Harnessing the power of private markets

The case for investing in private markets strengthens, especially given the inflation resilience that alternatives have demonstrated. Expected returns for core U.S. real estate rise 180bps to 7.5%. Forecasts for venture capital rise sharply and fall modestly for private equity (following equity market returns lower) and hedge funds.

Across many asset classes, the active alpha outlook improves. But make no mistake: Portfolio diversification will be a persistent challenge, especially when inflation risk is two-way and stock-bond correlation is no longer reliably negative. Staying invested beats hiding out in cash over virtually all time horizons. But investors will need to use all the tools available to build smarter portfolios for a world in transition.

The state’s role in the economy

How investors can assess the rise of industrial policy

The need is undeniable: Some of today’s most urgent challenges – notably, climate change, social strains and geopolitical tensions – likely require public sector as well as private sector commitment and capital.

That’s a key reason that industrial policy, and state intervention more broadly, are on the rise across the global economy. It’s the start of a new era, and a notable contrast to the laissez-faire of 1980-2008, especially in the U.S.

A framework for assessing the effectiveness of state intervention

We have crafted a framework for evaluating the effectiveness of state intervention, asking three key questions:

- Is the policy well-designed to address the defined problem?

- Can the policy lead to a sustainable end state?

- Are the necessary tools and/or political will in place to make the transition to that end state?

Industrial policies target a wide range of economic and noneconomic goals, with both short-term and long-term effects. We believe growing state intervention will present upside risks to inflation, upside risks to economic output in the short term, increased economic uncertainty and a higher cost of capital.

Investment implications

As we consider the investment implications of state intervention, we first note more uncertainty about the outlook for corporate margins from higher labor costs and potentially higher corporate taxes. This is counterbalanced somewhat by higher prices, increased consumer spending, and artificial intelligence (AI)-powered productivity gains.

The biggest beneficiaries of increased state intervention may lie in “real economy” sectors. Industrials are clear winners; utilities, energy, and parts of technology also stand to gain. Based on the real economy sectoral winners, regional markets tilted more heavily toward these type of companies may benefit the most. But investing based on sector exposure alone only goes so far; it will be key to consider the potential of thematic investing.

New policy initiatives will require private capital as well as government funding. Among alternative assets, real assets look set to be the primary beneficiaries, especially infrastructure, real estate, transportation and timber investments. Private debt and private equity funds will likely provide critical capital for both the physical assets and the new businesses that will be part of the broader story of rising state intervention.

Expanding the diversification toolkit

A smarter portfolio to mitigate shocks in a less predictable world

Diversifiers are investments meant to help achieve more robust outcomes. Stocks, broadly speaking, struggle when economic growth contracts, so we diversify with bonds, which tend to do well when growth weakens.

Fixed income remains an indispensable portfolio diversifier, yet it has proved less successful against bouts of inflation, recent and past. There is more than one kind of shock in financial markets, as investors were reminded recently. The expanded diversification toolkit aims to help insulate portfolios from a range of different shocks.

Indeed, as 2024 LTCMA forecasts call for ongoing, elevated macroeconomic uncertainty, finding additional sources of risk diversification may be as important as finding sources of return.

We propose such dimensions of diversification to create enhanced balanced portfolios, identifying a basket of further diversifiers to broaden out and complement a standard 60/40 stock-bond portfolio for a wider range of environments. The basket includes:

- Actively managed equity

- Tactical asset allocation strategies

- Risk premia strategies

- Currency overlays

- Thematic investing

- Alternative assets – particularly real assets, hedge funds and private credit, which exhibit low correlation to traditional assets and the opportunity for downside resilience, enhanced returns and inflation protection

We identify these diversifiers by drawing on historical evidence; the knowledge that they each shine in different economic environments; and by running simulations using our robust asset allocation model to capture the effects of different possible regimes.

Testing a portfolio incorporating the full range of these potential diversifiers, we examine their performance in aggregate and provide an example of the new, smarter, more robust balanced portfolio.

The smarter portfolio provided a smoother ride in our simulations – especially helpful because its value comes when it is most needed. Long-term wealth creation is not only about generating more return but also avoiding wealth destruction.

The diversifiers in our basket have historically delivered positive returns, are not costly (like traditional portfolio hedges) and are fairly valued. Those qualities make the present moment a timely one for reshaping portfolios by expanding the diversification toolkit.

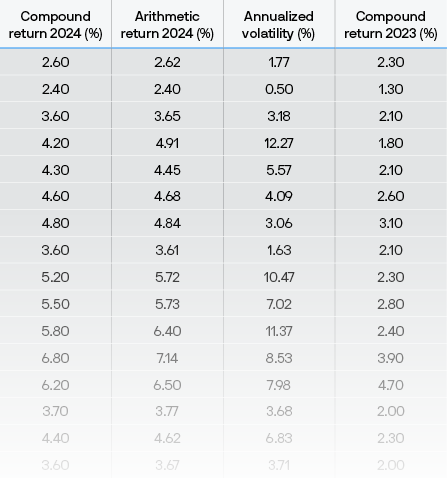

Matrices

Our expectations for returns, volatilities and correlations. Use our interactive version to download the excel in your chosen currency.

The assumptions are not designed to inform short term tactical allocation decisions. Our assumptions process is carefully calibrated and constructed to aid investors with strategic asset allocation or policy-level decisions over a 10- to 15-year investment horizon.

Our assumptions can be used to:

Develop or review a strategic asset allocation

Understand the risk and return trade-offs across and within asset classes and regions

Assess the risk characteristics of a strategic asset allocation

Review relative value allocation decisions

If you are looking for an asset class not listed in the published materials, please contact your J.P. Morgan representative.

Download matrix by currency

Download this year's Long Term Capital Market Assumptions report